How Much Money Is Enough?

- Daniel H. Satz, MS, CFP®

- Jul 27, 2022

- 4 min read

Updated: Oct 27, 2022

Key Takeaways

Time is the most valuable resource we have. If you can exchange money to free up time, the tradeoff is worth it.

The money messages we received as children can be hard to shake as adults.

Letting go of the feeling of scarcity will ease your stress and allow your money to make an impact on the people and causes most important to you.

Recently I’ve had meetings with several retired clients who have more money than they’ll ever spend. They don’t have children to pass it on to, so I asked them: “what do you want to happen with your money when you pass?” They give away a fair amount to charity, but it doesn’t really make a dent in their overall net worth.

Some of our wealthiest clients can seem to let go of the conservative money messages they learned as kids. Despite their burgeoning net worth statements, they can’t seem to bring themselves to spend a few extra dollars on a nicer bottle of wine, fly first class, or hire someone to paint their house. Even if they (or their parents) didn’t live through the Great Depression, there’s always that frugality and feeling of scarcity in the back of their minds. It keeps telling them that if they’re not careful with their money they could run out and spend their final years living on the street.

Everyone has a different relationship with money. Some clients struggle to keep their spending under control, while others can’t bring themselves to spend. For the latter group, we try to help them realize they are at virtually zero risk of running out of money before passing. Why not enjoy it while they still can?

It reminds me of the country music video by Kristian Bush: You Can’t Take it With You When You Go: Never seen a hearse with a trailer hitch.

One wealthy husband and wife we work with is each dealing with their own health complications. Now that he’s in his 90s and she’s in her late 80s, they’re starting to acknowledge their mortality and think about their legacy. They have three kids and four grandchildren who could all use some financial help, including two who still have large student loans at high-interest rates.

When I asked the couple why they didn’t want to help their high-achieving grandkids, they told me they didn’t believe the students would accept the money or that their parents would want them to receive it. That might be true, but I don’t think they were seeing the big picture. Their money is going to their children in a few years anyway after they pass on. “Wouldn’t you like to be around to see the relief it could bring your grandchildren and their parents?” I asked. I think they’re slowly coming around.

5 Steps For Helping You Get More Enjoyment From Your Wealth

1. Allow Yourself to Enjoy Life More

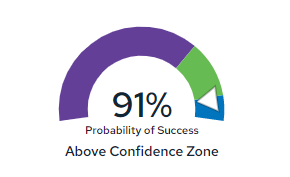

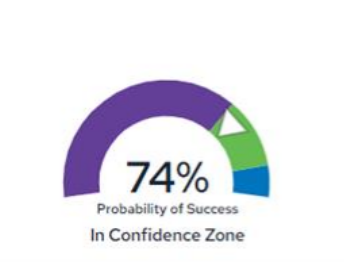

We “stress-test” our clients' plans to make sure those plans will be successful under a wide variety of circumstances – from recessions, bear markets, and wars, to the possibility of living to age 100. When we see a plan with a large amount of money likely to be left over, even if the client lives to 100, we start looking at their lifestyle and deliberately encourage them to spend and donate more.

One of our wealthy clients wanted a Lexus, but the monthly lease was about $150 more than what his current Honda Accord was costing him. So, he got another Accord. Again, he could easily afford the Lexus, but he couldn’t rationalize spending the extra money, even though it would have been a superior driving experience. We’re helping him realize it’s okay to splurge on an expensive dinner, box seats at the ballgame, or a nice bottle of wine once in a while. Take all of your kids and grandkids on an exotic family vacation to an island that they’ll never forget. You can’t put a price tag on memorable experiences your money can support.

One of the most common regrets people have on their deathbed is not about the things they did during their life – it’s the things they didn’t do when they had the chance.

2. Give More Money Away

In some cases, our wealthy clients don’t mind writing checks to charitable causes and organizations. What they have a problem with is finding charities that align with their values. We often help them vet potential causes and organizations with which they have common values or personal experience. In addition to supporting charities, they could gift more to their children, especially if the kids need help with worthwhile goals, such as tuition or a down payment on a house.

3. Using Your Money to Free Up Time

We have several wealthy frugal clients who insist on being do-it-yourselfers because they can’t bring themselves to pay other people to do chores like painting their house, raking the leaves, or mowing the lawn. But, if they did, they would have more free time to do things they want to do. Time is the most valuable resource we have. If you can exchange your money for more free time, it’s worth it. The same goes for managing your money. Many successful people insist on being do-it-yourselfers when it comes to managing their financial affairs. But think how much time and stress could be saved by offloading that responsibility to a planner?

4. Investing In Your Health

Paying for a gym membership or even a personal trainer is not a splurge. It’s part of maintaining good health so you’ll have the energy to live your life to the fullest. The same goes for buying costlier healthy food or a safer car or taking yoga classes or regular acupuncture sessions if it makes you feel better and less stressed.

5. Reevaluate Your Risk Tolerance

This may sound counterintuitive, but it can make sense for people with substantial cash reserves to start investing more aggressively later in life when there’s very little possibility of running out of money. That’s because you can grow your estate even more, which allows you to do even more good for your family and favorite causes when you pass.

Conclusion

If you or someone close to you has concerns about spending or donating money in retirement, please don’t hesitate to reach out. We’re very experienced in this area and happy to help.

DAN SATZ MS, CFP® is a Wealth Manager at Novi Wealth

Kommentare